Products

Transactions processed by Determination include either a product code or commodity code associated with a product. Determination uses this transaction data to drive rule selection, select exemption certificates, or fully exempt the product according to your configuration.

The US and INTL Tax Data Providers each provide a large set of products and related rules so that the correct tax rate is selected. For example: in France, coffee and tea are taxed at a Reduced Rate. Determination includes the following data:

- Product (in Harmonized product group): Coffee, tea, mate & spices.

- Rule (for authority France): 5040 (selected when the above product is included in the transaction).

- Rate (for authority France): RR (Reduced Rate); currently 5.5%.

Because Determination will always tax at the standard rate when a product is not matched, you do not need to maintain all possible products in Determination. This exception-based processing enables faster processing and less required maintenance of the Determination product tree.

Submitting and Matching Products

Determination provides two ways to include products in your transaction:

- You can submit a Commodity Code (also referred to as a Harmonized System Code in the EU and elsewhere). If you pass in the <COMMODITY_CODE> element, Determination attempts to directly match this code to a product in the Determination Product Tree. When Determination examines a Commodity Code, it attempts to match the code by first evaluating the entire code submitted, and then by stripping off one character at a time from the end of the code until it either finds a match or fails.

- You can submit a Product Code. If you pass in the <PRODUCT_CODE> element, Determination attempts to map this code to a product in the Determination Product Tree using customer-defined Product Mappings. By default, Determination examines the active Product Mapping Group specified on the transacting company Company Tax Preferences page; the input XML can also specify a different product mapping group if desired.

In each case:

- Custom products are searched first and, if one matches the product submitted in the transaction, that product is used.

- If no matching custom product is found, tax data provider products are searched and, if a matching product is found, it is used.

- If neither data provider contains a matching product, products are not considered and standard taxability (depending on other transaction values) applies to the transaction.

- Both the product code and commodity code are given equal weight, and the matching rule with the highest rule order is selected. In other words, if the product mapping or the commodity code match to Rule 1, that rule is selected. Neither code is given preference over the other.

-

The only difference is when Select Authority Rule by Commodity Code is set to Y. In this case, the parent/child relationship between products is more closely examined.

If there is both a rule for the parent product and rule for the child product, the child product's rule is selected. In this case, whether the product was listed as a commodity code or product mapping is disregarded, and the precedent of the first one to find the rule is broken.

The Determination Product Tree

The Determination Product Tree has two product lists (Tax Data Provider products and Custom Data Provider products) for each Product Group (such as US, Harmonized, and non-Harmonized).

Tax Data Provider products are organized hierarchically, based on:

- Goods and Services (International products only)

- Parent Product Category (product type)

- Commodity Code

As shown below, there can be more than one level of parent product category:

In the Harmonized Group example shown above, Coffee, tea, mate & spices is a Goods product contained in the product type 02 VEGETABLE PRODUCTS. Its Commodity Code is 09. Child products of this product all contain a commodity code beginning with 09.

You may notice the <PART_NUMBER> element when browsing the Input XML specification or using the Workbench. This element is not related to the product tree and has no effect on calculations. You can use it, if desired, to store additional product data in the audit database.

Product Matching Using Parent Products

The hierarchical arrangement of the product tree enables you to match products based on parent products using either of the following means.

- Product Code: If you submit a product code, and a rule contains a product that is a parent of the product submitted, the rule will match. For example, if you submit a product which maps to Tea, and the rule contains the product Coffee, tea, mate & spices, the rule will match (assuming a match on non-product criteria as well).

- Commodity Code: If you submit a commodity code, and a rule contains a product that is a parent of the product submitted, the rule will match. For example, if you submit the commodity code 0902 (which maps to Tea), and the rule contains the product Coffee, tea, mate & spices, the rule will match (assuming a match on non-product criteria as well).

- Commodity code matches do not need to match exactly. Consider a transaction where the submitted commodity code is 090230, which does not exist anywhere in the Product Tree. Determination attempts to first match that number, then strips off numbers one at a time to attempt to match a product. In this example, it would attempt to match 09023, which would fail, and then 0902, which would map to Tea and would match the rule as shown above.

Managing Custom Products

In some cases, the Determination Tax Data Providers may not contain all of the products you need. For example, a sales tax holiday may apply to a product that is not covered by Determination. In this case, you will need to create a custom product. You can add the following:

-

Create one or more Custom Products in the Custom Product Categories section of the Search Products page. You can create products in a hierarchy as shown above to enable partial matching, or in a flat list to require an absolute match.

You can also import custom products using the Determination Product Categories CSV Format. Tax holidays are explained in Sales Tax Holidays.

-

Create Product Mappings that your ERP system's product codes can map to the newly-created custom products. You must create mappings, even if your ERP system's product code uses the same name as the new custom product. You can create these mappings on the Product Mappings page.

If you prefer, you can import product mappings using the Product Mappings CSV Format.

-

Create Custom Rules, Product Exemptions, and Exemption Certificates that result in the desired taxability for the custom product for each authority or customer. For more information, see Rules, Exemption Certificates, and Exemptions and Licenses Search.

Commodity Codes must be unique within a Custom Product Group but can duplicate (override) a commodity code in a Tax Data Provider Product Group.

For example, you cannot use two commodity codes with the number 09 in the Harmonized Custom Product Categories group.

You can use the commodity code 09 for a single custom product to force Determination to select a Custom Product with that number rather than a Tax Data Provider product with that number.

For more on Product Groups, see the following section.

Custom Products can be created by a custom data provider shared with the custom data provider's child companies. If a company obtains its data from a Custom Data Provider, it cannot manage its own products. For more information, see Data Providers - Tax, Custom, and Others.

Custom product mappings that are mapped to the US Product Group cannot access products in the INTL Product Group. For example, if Puerto Rico was incorrectly identified as a country, a custom product mapped to the US Product Group would not be located. Countries other than the US reference the INTL Product Group.

Product Groups

Determination provides one US and six International Product Groups. These groups contain products for authorities that use similar product taxability. When you create custom products or custom authorities, you need to specify the same Product Group used by other authorities found in the transaction. In the following example, you would need to add a product to three Product Groups:

- If you are adding a product for which you want to create taxability rules in France, add it to the Harmonized group.

- If you want it to also be applicable to the US, add it to the US group.

- And finally, if you want it to be applicable in India, also add it to the Non-Harmonized group.

You can export custom products, then re-import them to another Product Group, using Import/Export.

Each authority specifies membership in one (and only one) Product Group on their Edit Authorities page:

International Product Groups Supported by INTL Tax Data

-

Harmonized: An International Product group with Goods and Services. The Goods portion of the product group contains information from the Harmonized Coding System of the World Customs Organization.

For more information, see the World Customs Organization web site.

-

Non-Harmonized: An International product group in which product names and commodity codes are based on the UNSPSC (United Nations Standard Products and Services Code).

For more information, see the UNSPSC web site.

- Brazil: A product group for products specific to Brazil authorities.

-

India GST: A product group specific to India authorities.

Other International Product Groups Not Supported by INTL Tax Data

These product groups can be used to associate products with Custom Authorities, but are not recommended for use:

- Canada: A product group for products specific to Canada custom authorities.

- Independent: A product group for products not falling into any other category.

Thomson Reuters strongly advises that you add any custom products to the Harmonized, Non-Harmonized, or Brazil product groups rather than the Canada or Independent product groups. In this way, you can share these products between your custom authorities and the standard Tax Data Provider authorities.

US Product Group Supported by US Tax Data

-

US: This group is attached to all US authorities. Product names and commodity codes are based on the UNSPSC (United Nations Standard Products and Services Code).

For more information, see the UNSPSC home page.

Products Tasks

On the Products pages, you can:

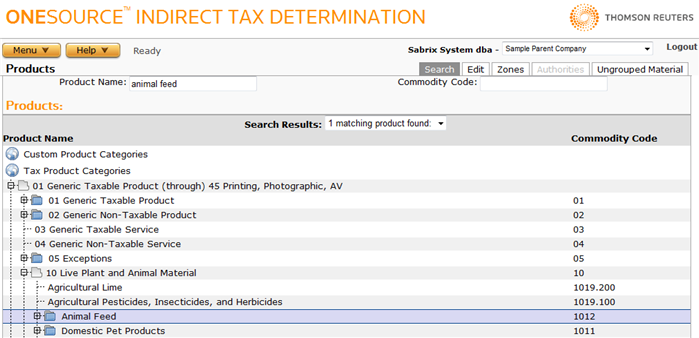

- Use the Search Products page to browse the list of Tax Data Provider and Custom Data Provider products and to add or delete Custom Products.

- Use the Edit Products page to view details about the selected Tax Data Provider product or add, modify, or delete a Custom Data Provider product.

- Use the Product Zones and Product Authorities pages to quickly specify full exemption for the selected product in one or more authorities.

- Use the Ungrouped Material page to add a custom product to a Material Set.

If you need to perform one or more of these related tasks:

- Add Product Mappings from your ERP system's product codes to a Tax Data Provider or Custom Data Provider product.

- Add custom Rules to map a product to a rate for a specified authority.

- Add an exemption which exempts the product for a specified customer. See Exemptions and Licenses Search.

- Manage customer-defined groups of products using Material Sets and Lists.