Rules

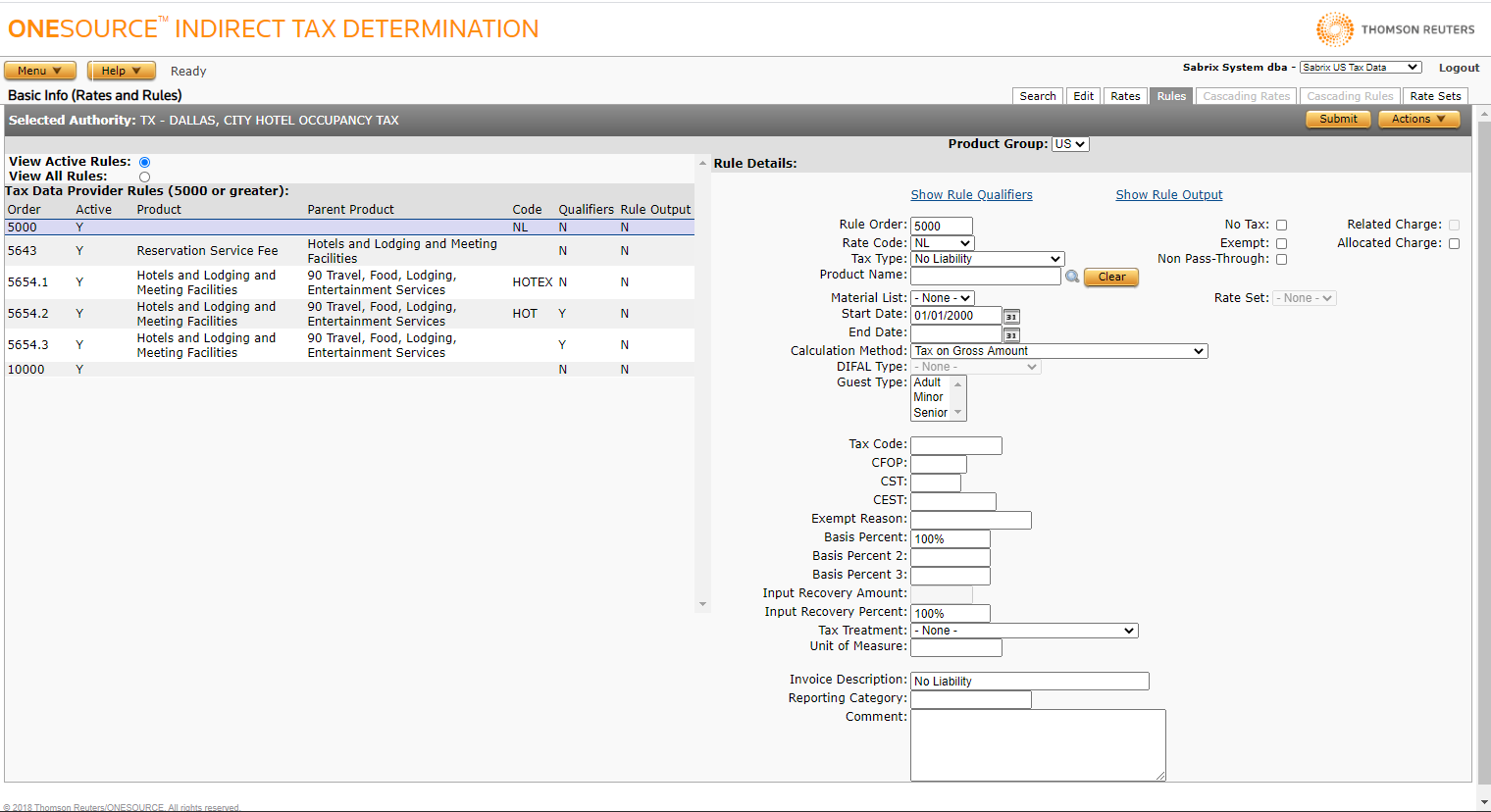

Menu > Tax Data > Authorities > Basic (Rules and Rates) > Rules

Use this page to manage product taxability rules for the selected authority based on the type of your company.

- The Tax Data Provider can manage TDP rules (5000 or greater).

- Non-TDP companies can manage custom rules (1-4999).

For example, for the France authority, only the INTL Tax Data company can manage TDP rules 5000 or greater, while any company can add custom rules for that authority. You can also configure Rule Output or Rule Qualifiers for Custom rules, and view them for Tax Data Provider rules.

For complete information about rule processing, rule matching, and other rule criteria, see Rules.

To select a different authority's rules, first select that authority on the Search Authorities page.

The Rules page shows:

- A list of rules associated with the selected authority on the left side.

- Details about the currently-selected rule on the right side. See the Rule Details Field Reference (right pane) table below for definitions.

|

Rule List Field Reference |

|

|---|---|

|

View Active Rules View All Rules |

Specifies if you want to view only active rules or all rules. Default is Active Rules. A rule is considered Active if it has a start date less than or equal to the current date and an end date greater than or equal to the current date. |

|

Order |

The order in which the rules are processed. |

|

Active |

Indicates whether the rule is active (Y) or inactive (N). |

|

Product |

The product exception to test for. To create product categories see Edit Products. |

|

Parent Product |

The parent product of the exception to test for. |

|

Rate or Fee |

One of the defined short Rate or Fee Codes from the Rates page. |

|

Qualifiers |

If Y, indicates that this rule specifies Rule Qualifiers. |

|

Output |

If Y, indicates that this rule specifies Rule Output. |

Click a link below to go to instructions for completing the task and to see details of required and optional information.

In addition to managing rules on this page, you can also add custom products and product mappings. For instructions, see Add products and product mappings.

Creating Catch-All Rules

There are two instances in which you may want to configure catch-all rules to achieve the desired calculation results: No Liability Rule and No Tax Rule.

No Liability Rule

To ensure correct tax calculations on transactions that result in No Liability, create the following rule using the data shown here using the procedure "To Add a rule" below:

|

Field |

Req? |

Value |

|---|---|---|

|

Rule Order |

Y |

1 |

|

Code |

Y |

NL |

|

Tax Type |

Y |

No Liability |

|

Start Date |

Y |

Set to start date of earliest custom rule you will configure. The date range you configure cannot overlap with another date range used by a rule using the same Rule Order. |

No Tax Rule

You can create a rule that will terminate rule processing for your custom authority/custom rules so that Determination does not attempt to fall back to other rules or cascading rules. To do so, create the following rule using the data shown here using the procedure "To Add a rule" below:

|

Field |

Req |

Value |

|---|---|---|

|

Rule Order |

Y |

4999 |

|

Code |

Y |

(None) |

|

No Tax Checbox |

Y |

Checked When the No Tax checkbox is selected, Code and Rate Set are unavailable. |

|

Start Date |

Y |

Set to start date of earliest custom rule you will configure. The date range you configure cannot overlap with another date range used by a rule using the same Rule Order. |

- Select Add Rule from the Actions menu.

- Enter the rule details, using the Rule Details Field Reference (right pane) below.

- Click Submit to save the rule.

- Select the rule you want to copy.

- Select Copy Rule from the Actions menu.

- Choose one of the following:

- Click End date original order to end-date the old rule. If you do so, you are prompted to specify an end date for the original rule before editing the new rule, which will use the same rule order as the original rule.

This option does not appear if you are copying a rule that is already end-dated.

-

Click Use new rule order to not end-date the old rule. If you do so, you are prompted to enter a new rule order for the copied rule and click OK.

If the rule you are copying is already end-dated, modify the end date after you copy the rule to enable it for the desired period.

- Click Cancel to exit without copying the rule.

- Enter the rule details, using the Rule Details Field Reference (right pane) below.

- Click Submit to save the rule.

- Select the rule you want to copy.

- Select Copy Rule from the Actions menu.

- Click on one of the following:

- Use new rule order, then enter a new rule order (in the range of 1-4999) for the copied rule and click OK.

- Cancel to exit without copying the rule.

- Enter the rule details, using the Rule Details Field Reference (right pane) below.

- Click Submit to save the rule.

- Select a rule from the rule list.

- Edit the rule details, using the Rule Details Field Reference (right pane) below.

- Click Submit to save your changes.

- Select the rule you want to delete.

- Select Delete Rule from the Actions menu.

- Click OK to confirm the deletion.

The Export option is only available for Rules associated with Tax Data Provider authorities. To export Rule(s) associated with a Custom Authority, export the entire authority.

- Select the rule you want to export.

- Select Properties from the Actions menu.

- Click one of the following. In either case, rate and product data associated with the selected rule (s) are also exported:

- This Rule to export only the selected rule.

- This Rule and All Siblings to export the selected rule and all other custom rules and custom cascading rules associated with the selected authority.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

The following table lists rule details in the order in which they appear in the Rule Details pane. For a description of rule details by type (Rule Input, Rule Tax Criteria, and Rule Output), see Rules.

Rate Code, Rate Set, No Tax, and Exempt fields are interdependent. A rule requires a Rate Code or Rate Set or the No Tax or Exempt checkbox must be selected.

| Rule Details Field Reference (right pane) | ||

|---|---|---|

|

Field |

Req? |

Description |

|

Show Rule Qualifiers |

N/A |

Displays the Rule Qualifiers page, where you can set rule qualifiers based on previous taxes calculated, customer licenses, reference lists, or values contained in specified input XML elements. |

|

Show Rule Output |

N/A |

Displays the Rule Output page, which includes additional data that is audited and returned in the output XML each time this rule is applied. |

|

Rule Order |

Y |

The order in which the rule is applied. Lowest-numbered rules are processed first. Custom rules fall in the range 0-4999, while Tax Data Provider rules are numbered 5000 or greater. A rule order can be duplicated if the date ranges for rules using the same order do not overlap. For example, Rule Order can apply to two rules, one with a date range of 1/1/2000-12/31/2005, and another with a date range starting with 1/1/2006. |

|

No Tax |

Y |

Indicates that no tax is charged for this rule. When the No Tax checkbox is selected, Code and Rate Set are unavailable. |

|

Related Charge |

Opt. |

If checked, indicates that this rule applies to a related charge when such a product is included in a transaction. If a related charge is submitted and the selected rule's Related Charge box is not checked, the related charge is treated as a standard product. Even when a rule indicates a related charge, you should also specify a rate code. If the parent product is not found, this rate is used instead of the parent product rate. For more information, see Dependent Product Taxability. |

| Allocated Charge | N/A |

When selected, the taxable basis of this line item is adjusted according to the taxability of the non-allocated items in the invoice. For additional information, see Allocated Charges. |

|

Rate Code |

Y |

One of the defined Rates and Fees associated with this rule's authority. You can select both Custom Data Provider and Tax Data Provider rates/fees. For a given rule, select either a Code or Rate Set, but not both, unless either the Exempt or No Tax checkbox is selected. |

|

Exempt |

Y |

Indicates full exemption when checked. When the Exempt checkbox is selected, Code and Rate Set are unavailable |

|

Tax Type |

Y |

One of the supported tax types. The list contents is dependent on the Tax Data Type (International or US) indicated on the Search tab. |

| Non Pass-Through | Opt. |

If checked, this Authority’s tax result will not be present in the tax engine output response. The tax result will be present in audit, however. (Note): For cases where this is checked, there will be a new System Message in tax result output with Code NON PASS-THROUGH RULE, and Description Applied non pass-through rule for <Authority> and <Tax Amount> where Authority will contain the Authority name and Tax Amount will contain the appropriate tax amount and currency value. |

|

Product Name |

Opt. |

The product exception to test for. On a rule, you can specify either an individual Product or a Material List, but not both. If a Material List is specified, any product on that list will match the rule. If a Product is specified, only that product will match the rule. To select a product:

If you enter a commodity code, the system attempts to match the code first by the full code and then by stripping off characters from the end of the code, one at a time, until no code remains. |

|

Material List |

Y |

One of the configured Material Sets and Lists belonging to an Authority Material Sets. The default is None. On a rule, you can specify an individual Product Name or a Material List, but not both. If a Material List is specified, any product on that list will match the rule. |

|

Rate Set |

Y |

One of the defined Authority Rate Sets associated with this rule's authority. A Code or Rate Set, but not both, must be selected for a given rule unless either the Exempt or No Tax box is checked. |

|

Start Date |

Y |

The beginning effective date (MM/DD/YYYY) for the rule. The date range cannot overlap another date range used by a rule using the same Rule Order. |

|

End Date |

Opt. |

The ending effective date (MM/DD/YYYY) for the rule. If you do not enter a date here, the rule will remain in effect indefinitely. |

|

Calculation Method |

Y |

The calculation method applied to tax situations that use this rule. Methods are:

|

|

Calculation Method (continued) |

Y |

Calculation Methods (continued):

For additional information on Brazilian calculations, see Brazil Tax Calculations. If you select a Fee-based method, this rule can only be applied to a quantity-based fee. The number following each choice indicates the value stored in the audit tables for Calc Method. If your audit database includes data from Sabrix Solution versions prior to Version 4.4, you may also see the following methods listed:

These methods have been superseded by the Contributing Authorities feature. |

| DIFAL Type | Opt. |

An optional field only used if the Calculation Method is Rate Differential (Brazil Only). The appropriate value from the drop-down list is dependent on the Brazilian legislative laws related to Brazil DIFAL. Note: The option None from the drop-down list is only available to support previously created rules. |

|

Tax Code |

Opt. |

An optional Tax Codes Example to match in the transaction input XML data. If a tax code is entered here, it must be present in the transaction data or the rule cannot be matched. Also, if the rule specifies a Authority Rate Sets, any rate set rate you want to match must either contain the same tax code entered here or a blank tax code, or the rate cannot be selected. |

|

Exempt Reason |

Opt. |

An Exempt Reason to match either:

|

|

Basis Percent |

Opt. |

An optional basis percentage to apply for the rule. Enter a percentage to 10 decimal places. For example, 50.25 = 50.25%. Basis percentage can be applied to a transaction through input XML, an exemption certificate, or a rule, in that order of precedence (input XML always overrides certificate data, which overrides rule data). |

|

Basis Percent 2 |

Opt. |

An optional basis percentage to apply for the rule. Enter a percentage to 10 decimal places. For example, 50.25 = 50.25%. Basis percentage can be applied to a transaction through input XML, an exemption certificate, or a rule, in that order of precedence (input XML always overrides certificate data, which overrides rule data). |

|

Basis Percent 3 |

Opt. |

An optional basis percentage to apply for the rule. Enter a percentage to 10 decimal places. For example, 50.25 = 50.25%. Basis percentage can be applied to a transaction through input XML, an exemption certificate, or a rule, in that order of precedence (input XML always overrides certificate data, which overrides rule data). |

|

Input Recovery Amount |

Opt. |

Value applies to VAT transactions only, and is mutually exclusive with Input Recovery Percent. Indicates the input recovery amount to be audited whenever this rule is applied to a transaction whose direction is input. The audited amount cannot exceed the tax amount for the transaction. If neither Input Recovery field is populated, input recovery is assumed to be 100% of the tax amount. For more information, see VAT Recoverability. |

|

Input Recovery Percent |

Opt. |

Value applies to VAT transactions only, and is mutually exclusive with Input Recovery Amount. Indicates the input recovery percent of the tax amount to be audited whenever this rule is applied to a transaction whose direction is input. The resulting audited amount cannot exceed the tax amount for the transaction. If neither Input Recovery field is populated, input recovery is assumed to be 100% of the tax amount. For more information, see VAT Recoverability. |

|

Tax Treatment |

Y |

Indicates one of the following:

For more information, see Deferred Taxes. |

|

Unit of Measure |

N/A |

A deprecated field previously used to indicate an optional unit of measure to relate to a flat fee (for example, GALLON, TIRE). Please see the Units of Measure Conversion conceptual topic for a description of how Units of Measure are maintained and converted by Determination. The ampersand character (&) cannot be used in a unit of measure. |

|

Invoice Description |

Opt. |

This description is returned to the business application for use on the invoice to be generated. |

|

Reporting Category |

Opt. |

An optional category to aid in the creation of reports and returns. For example, you can include Reporting Categories for specific industries. |

|

Comment |

Opt. |

An optional comment. If a tax code is entered here, it is returned in the Output XML, overriding any ERP Tax Code stored for the selected authority as indicated on the Edit Authorities page. |

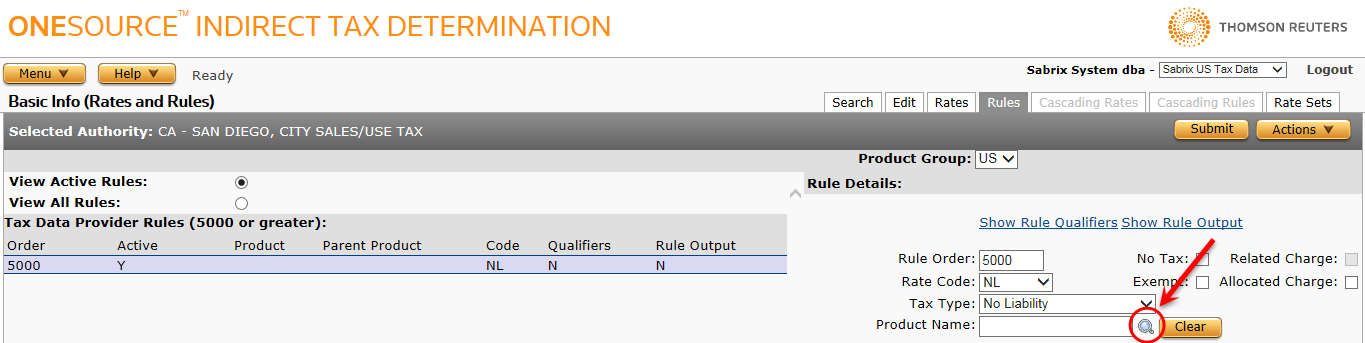

Add products and product mappings

You may find it convenient to add custom products and product mappings while you are also managing authority rules.

- Click the Rules tab of the Basic Info (Rates and Rules) page.

- Click the Find icon next to Product Name in the Rule Details section.

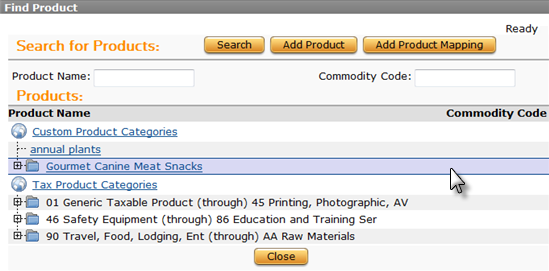

- In the Find Product window, click in the row of a custom product category. Do not select the link if you want to add a product.

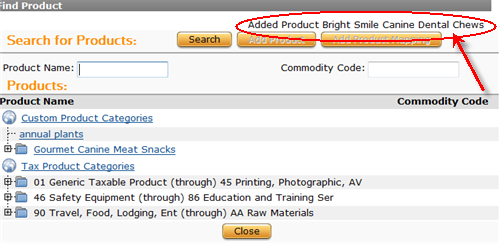

In this example, the Gourmet Canine Meat Snacks row is selected. When you click a row, the Add Product and Add Product Mapping buttons become available.

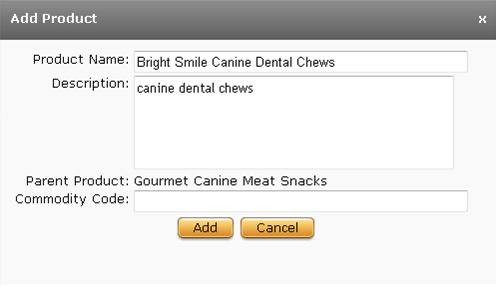

- In the Add Product window, enter the Product Name and Description. The Parent Product is the name of the row you selected.

- Click Add to add the new product and return to the Search window. The new product is identified in the top right of the window. Click Close.

- To add a product mapping, repeat steps 1 - 3, and then click the Add Product Mapping button.

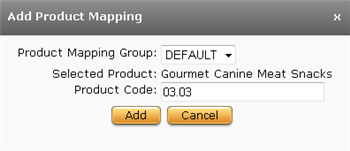

- In the Add Product Mapping window, select a Product Mapping Group, if different from Default, and then enter a Product Code.

The Selected Product is the is the name of the row you selected.

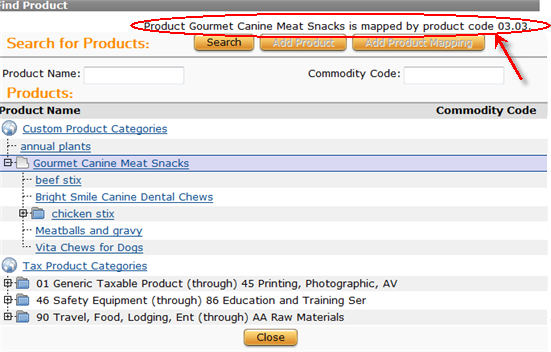

- Click Add to add the new product mapping and return to the Search window. The new product mapping is identified in the top right of the window. Click Close.

For additional ways to add products and product mappings, see Add a product and product mapping together and Add a product mapping .